Credit: self.inc

While advocates of payday loans say they grant loan access to people with poor or no credit, critics say these “short term” loans unfairly target minority populations and trap people into lengthy debt cycles.

So, how do payday loans work? Here’s a breakdown to help you figure things out for yourself. In this article, we’ll explore what a payday loan is and how it works, how to qualify, differences from state to state, some pros and cons of payday loans, and some responsible alternatives to payday lending.

What is a payday loan and how does it work?

A typical payday loan is a small-dollar loan (usually about $100-$1,500) with a two-week term that is due in a single lump payment on your next payday. At least, that’s how it works in theory.

If the term “payday loan” doesn’t ring a bell, here are some other names for it:

- Cash advance

- Short-term loan

- Payday advance loan

- Fast cash or fast loan

- Bad credit loan

- Deferred deposit transaction

- Paycheck advance

According to the Consumer Financial Protection Bureau (CFPB):

“To repay the loan, you generally write a post-dated check for the full balance, including fees, or you provide the lender with authorization to electronically debit the funds from your bank, credit union, or prepaid card account. If you don’t repay the loan on or before the due date, the lender can cash the check or electronically withdraw money from your account.”

These loans target people with poor or no credit, or little financial literacy, who need access to cash immediately. But if you have bad credit or no credit, what other options do you have to access fast cash in an emergency?

We’ll explore some responsible alternatives to payday loans at the end of this piece, but first let’s break down how to qualify for payday loans.

How do you qualify for a payday loan?

It is quite easy for payday loan borrowers to qualify for this type of short term loan. All a borrower needs is to have an open checking account in good standing. The payday borrower will also need to prove their income and have some form of identification. A payday loan lender will not run a credit check or ask further questions. Since lenders do not check your credit score, many borrowers find themselves in a payday loan trap, unable to pay their debt within their repayment term.

The pros of payday loans

Here’s why some people turn to payday loans, despite the often negative consequences:

Pro 1: They’re easy to access

The number one advantage of payday loans is that they’re easy to access. In fact, many cash advance lenders promise access to cash within 24 hours and an immediate lending decision. Some are even available 24 hours a day, 7 days a week and have online applications.

Unlike traditional loans, which can take time to apply for, these loan applications can take as little as five minutes.

Pro 2: They have fewer requirements than other loans

Traditional lenders usually require a Social Security number, photo ID, proof of income, a credit check and will verify your ability to repay a loan. Unlike traditional personal loans, most “fast cash” loans have fewer requirements to apply.

Generally, all you need to apply for a payday loan is to:

- Be at least 18 years of age

- Have a government-issued ID or Social Security number

- Have a regular job or other regular source of income

- Have an active bank account

While having fewer requirements makes getting cash more convenient, keep in mind that the additional requirements from banks and other lenders were often put in place to help protect you.

Pro 3: They don’t check your credit

Unlike traditional loans where you need good credit to be approved, payday loans don’t require a credit history. Since they don’t pull your credit, that also means no hard credit inquiry, which can lower your credit score by several points.

Except in rare cases, however, payday loans won’t help build the credit you need to move onto higher quality financial products in the future.

Learn how to build credit by reading our post on “How to Build (or Rebuild) Credit.”

Pro 4: It’s an unsecured loan

Unlike a car title loan, traditional auto loan or mortgage, payday loans are not secured by personal property. This means that if you default (don’t pay), the lender can’t seize your property as a consequence.

While not secured, payday lenders often have access to your bank account as a condition of the loan, which is a different type of risk. They can also take other measures, such as sending your debt to collections or taking you to court over outstanding balances.

The cons of payday loans

When it comes to payday loans, the Federal Trade Commission, a government regulatory body focused on preventing fraudulent, deceptive and unfair business practices, states:

“The bottom line on payday loans: Try to find an alternative. If you must use one, try to limit the amount. Borrow only as much as you can afford to pay with your next paycheck – and still have enough to make it to next payday.”

Which brings us to the first disadvantage of payday loans. …

Con 1: They’re expensive

Depending on the state, payday loans have high interest rates that average about 400%. For comparison, many personal loans charge about 4%-36% interest, while credit card interest ranges from about 12-30%.

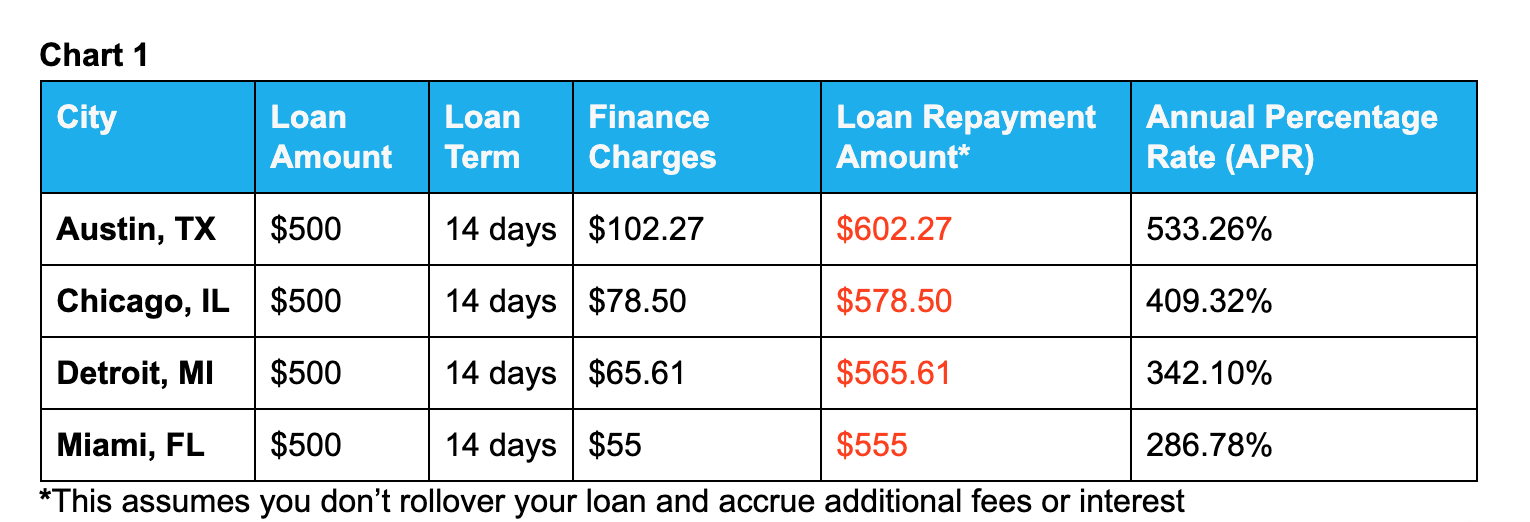

This image shows just how high these rates can go, depending on where you live.

To break this down into a more concrete example, here’s what a payday loan of $500 could cost you in a few different cities across the US as of July 2019:

Looking at this city sample, it could cost $55-$102.27 to borrow a total of $500.

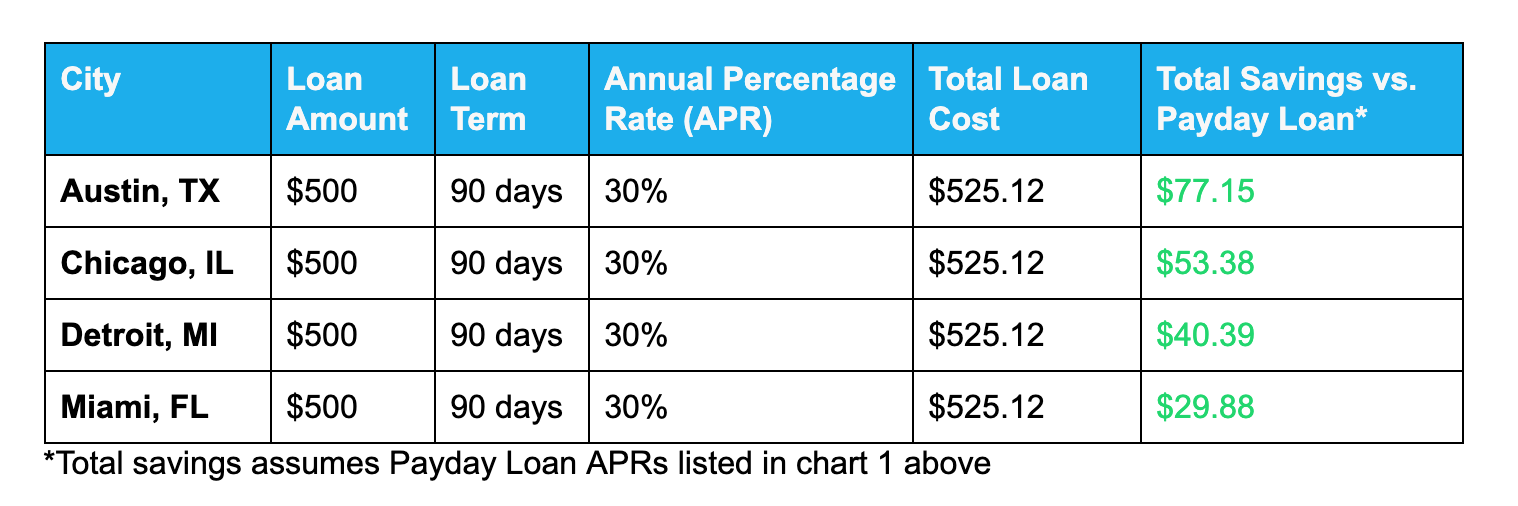

In contrast, if you had a $500 loan with a 30% APR, you would only pay an extra $25.12 in interest for a three-month term, making the total cost of the loan $525.12.

Here’s how much that lower interest rate would save you in each of the cities above:

Following this example, you could save anywhere from $30-$77+ for every $500 you borrow if you use a traditional loan instead.

Notice also, __with the 30% interest loans, you have a longer time period to pay back less money. __

However, many traditional lenders require a minimum credit score to qualify. And the better your credit, the more money you could save over time.

Payday loans are sometimes harder to pay back than a traditional loan, because the lender did not verify your ability to repay before lending you money. Payday lenders don’t generally assess your debt-to-income ratio or take your other debts into account before giving you a loan either.

Con 2: Payday loans are considered predatory

A predatory loan is defined as having unfair, misleading or unaffordable terms and has the potential to trap users in a cycle of debt. Payday loans are viewed as a type of predatory loan because of the high costs that can escalate quickly.

__Some warning signs of predatory loans include: __

- The lender doesn’t check whether you’ll be able to repay the loan. If you can’t repay the loan, you could be forced to roll the loan over repeatedly, accumulating new fees each time.

- The loan doesn’t help you build credit. If the loan provider doesn’t report to any of the three major credit bureaus (Experian, Equifax or TransUnion), this could be a warning sign. If you’re unsure whether or not a loan reports to the credit bureaus, ask.